UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 6)*

CRYO CELL INTERNATIONAL, INC.

(Name of Issuer)

Common Stock

(Title of Securities)

228895108

(CUSIP Number)

| Kevin Friedmann, Esq. | |

| Richardson & Patel LLP | |

| 750 Third Avenue, 9th Floor | |

| New York, New York 10017 | |

| (212) 561-5559 | |

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

May 30, 2012

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. ¨

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 2228895108

| 1. | Names of Reporting Persons | |

| IRS Identification Nos. of Above Persons (Entities Only) | ||

| Ki Yong Choi | ||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) | |

| (a) x | ||

| (b) ¨ | ||

| 3. | SEC Use Only | |

| 4. | Source of Funds (See Instructions) | PF |

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) | ¨ |

| 6. | Citizenship or Place of Organization | United States |

| Number of Shares Beneficially Owned by Each Reporting Person With: | ||

| 7. | Sole Voting Power | 1,953,096 |

| 8. | Shared Voting Power | 233,472 (1) |

| 9. | Sole Dispositive Power | 1,953,096 |

| 10. | Shared Dispositive Power | 233,472 (1) |

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person | 2,186,568 |

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) | ¨ |

| 13. | Percent of Class Represented by Amount in Row (11) | 18.4% (2) |

| 14. | Type of Reporting Person (See Instructions) | IN |

| (1) | By virtue of being a co-trustee of the Ki Yong Choi and Laura H. Choi, as trustees UAD 7/27/01 FBO Choi Family Living Trust (the “Trust”), Mr. Choi shares voting and dispositive power over the 233,472 shares of common stock held by the Trust. |

| (2) | Based upon 11,853,227 shares of common stock outstanding as of April 13, 2012 as reported in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended February 29, 2012. |

CUSIP No. 2228895108

| 1. | Names of Reporting Persons | |

| IRS Identification Nos. of Above Persons (Entities Only) | ||

| Ki Yong Choi and Laura H. Choi, as trustees UAD 7/27/01 FBO Choi Family Living Trust | ||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) | |

| (a) x | ||

| (b) ¨ | ||

| 3. | SEC Use Only | |

| 4. | Source of Funds (See Instructions) | PF, OO |

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) | ¨ |

| 6. | Citizenship or Place of Organization | California |

| Number of Shares Beneficially Owned by Each Reporting Person With: | ||

| 7. | Sole Voting Power | 0 |

| 8. | Shared Voting Power | 233,472 (1) |

| 9. | Sole Dispositive Power | 0 |

| 10. | Shared Dispositive Power | 233,472 (1) |

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person | 233,472 (1) |

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) | ¨ |

| 13. | Percent of Class Represented by Amount in Row (11) | .02% (2) |

| 14. | Type of Reporting Person (See Instructions) | OO |

| (1) | By virtue of being a co-trustee of the Ki Yong Choi and Laura H. Choi, as trustees UAD 7/27/01 FBO Choi Family Living Trust (the “Trust”), Mr. Choi shares voting and dispositive power over the 233,472 shares of common stock held by the Trust. |

| (2) | Based upon 11,853,227 shares of common stock outstanding as of April 13, 2012 as reported in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended February 29, 2012. |

Item 1. Security and Issuer

This Amendment No. 6 to Schedule 13D (“Amendment No. 6”) by Ki Yong Choi and Ki Yong Choi and Laura H. Choi, as trustees UAD 7/27/01 FBO Choi Family Living Trust (the “Trust” and collectively, the “Reporting Persons”) amends and supplements the statement on Schedule 13D originally filed on July 26, 2007 (the “Original Schedule 13D”, and as amended and supplemented by Amendment No. 1 to Schedule 13D filed on July 31, 2007, Amendment No. 2 to Schedule 13D filed on May 1, 2009, Amendment No. 3 to Schedule 13D filed on May 10, 2011, Amendment No. 4 to Schedule 13D filed on May 23, 2011, Amendment No. 5 to Schedule 13D filed on August 22, 2011 and this Amendment No. 6, the “Schedule 13D”) by Mr. Choi relating to the common stock, par value $0.01 per share (the “Common Stock”) of Cryo-Cell International, Inc., a Delaware corporation (the “Issuer”), with its principal executive offices located at 700 Brooker Creek Boulevard, Suite 1800, Oldsmar, Florida 34677. Information given in response to each item shall be deemed incorporated by reference in all other items, as applicable.

Item 4. Purpose of Transaction

Item 4 of the Schedule 13D is hereby amended to include the following:

On May 30, 2012, the Reporting Persons, in compliance with the bylaws of the Issuer, submitted to the Issuer a formal notice (the “Notice”) to nominate six individuals, including Ki Yong Choi and Michael W. Cho, Ph.D., both of whom were former directors of the Issuer, together with Warren Hoeffler, Ph.D., Michael D. Coffee, Gary Weinhouse and Ajay Badlani (each a “Nominee” and collectively the “Nominees”) for election to the Issuer’s Board of Directors at the Issuer’s 2012 Annual Meeting of stockholders (including any adjournment or postponement thereof or any special meeting held in lieu thereof). A copy of the Notice is filed as Exhibit 99.2 hereto and is incorporated by reference into this Item 4 as if set out herein in full. The Notice was amended on May 31, 2012 to include additional information about certain of the Nominees. A copy of the amendment is filed as Exhibit 99.3 hereto and is incorporated by reference into this Item 4 as if set out herein in full.

Mr. Choi currently intends to conduct a proxy solicitation seeking to elect these individuals to the Issuer’s Board of Directors. Mr. Choi submitted the Notice, and intends to conduct such proxy solicitation, because he has lost confidence in the members of the Board and the Chief Executive Officer and believes that a new Board and a new Chief Executive Officer could improve the financial performance of the Issuer.

Depending on various factors, including the Issuer’s financial position, results of operations and strategic direction, the outcome of discussions with other stockholders and the Issuer, actions taken by the Issuer, and the trading price levels of the Common Stock of the Issuer, the Reporting Persons may in the future take such actions with respect to their investment in the Issuer as they deem appropriate including, without limitation, purchasing additional shares of Common Stock of the Issuer or selling some or all of their shares of Common Stock of the Issuer, and/or otherwise changing their intentions with respect to any and all matters referred to in paragraphs (a) through (j) of Item 4 of Schedule 13D.

Mr. Choi has engaged, and may engage additional, advisors to assist him, including consultants, accountants, attorneys, financial advisors or others, and may contact other stockholders of the Issuer and/or other relevant parties to discuss any and all of the above.

In connection with his intended proxy solicitation, Ki Yong Choi intends to file a proxy statement with the Securities and Exchange Commission (the “SEC”) to solicit stockholders of the Issuer. MR. CHOI STRONGLY ADVISES ALL STOCKHOLDERS OF THE ISSUER TO READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN ANY SUCH PROXY SOLICITATION. SUCH PROXY STATEMENT, WHEN FILED, AND ANY OTHER RELEVANT DOCUMENTS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT HTTP://WWW.SEC.GOV.

PARTICIPANT INFORMATION

In accordance with Rule 14a-12(a)(1)(i) under the Securities Exchange Act of 1934, as amended, the following persons are anticipated to be, or may be deemed to be, participants in any such proxy solicitation: Ki Yong Choi, Gary Weinhouse, Michael W. Cho, Warren Hoeffler, Michael D. Coffee and Ajay Badlani. Certain of these persons hold direct or indirect interests as follows: Mr. Choi holds of record or beneficially a total of 2,186,568 shares of the Issuer’s Common Stock and Dr. Michael W. Cho is the record holder of 14,166 shares of the Issuer’s Common Stock. The Nominees, Messrs. Choi, Weinhouse, Cho, Hoeffler, Coffee and Badlani, each have an interest in being nominated and elected as a director of the Issuer.

Item 7. Material to Be Filed as Exhibits

Exhibit 99.1 Joint Filing Agreement between the Reporting Persons.

Exhibit 99.2 Notice of Stockholder Nomination dated May 30, 2012

Exhibit 99.3 Amendment to Notice of Stockholder Nomination

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

May 31, 2012

| /s/ Ki Yong Choi | ||

| Ki Yong Choi | ||

Ki Yong Choi and Laura Choi, as Trustees UAD 7/27/01 FBO Choi Family Living Trust | ||

| By: | /s/ Ki Yong Choi, Trustee | |

| Ki Yong Choi, Trustee | ||

| By: | /s/ Laura H. Choi | |

| Laura H. Choi, Trustee | ||

Exhibit 99.1

JOINT FILING AGREEMENT

We, the signatories of the statement to which this Joint Filing Agreement is attached, hereby agree that such statement is filed, and any amendments thereto filed by any and all of us will be filed, on behalf of each of us, and that this Agreement be included as an exhibit to such statement.

Dated: May 31, 2012

| /s/ Ki Yong Choi | ||

| Ki Yong Choi | ||

Ki Yong Choi and Laura Choi, as Trustees UAD 7/27/01 FBO Choi Family Living Trust | ||

| By: | /s/ Ki Yong Choi, Trustee | |

| Ki Yong Choi, Trustee | ||

| By: | /s/ Laura H. Choi | |

| Laura H. Choi, Trustee | ||

May 30, 2012

VIA FEDERAL EXPRESS AND

VIA FACSIMILE TO (813) 855-4745

Corporate Secretary

Cryo-Cell International, Inc.

700 Brooker Creek Boulevard, Suite 1800

Oldsmar, Florida 34677

Dear Sir or Madam:

In accordance with Article II, Sections 3 and 10 of the Amended and Restated Bylaws of Cryo-Cell International, Inc., a Delaware corporation (the “Company”), this letter constitutes notice (“Notice”) that Mr. Ki Yong Choi, in his individual capacity, and Ki Yong Choi & Laura H. Choi TR U/A DTD 7/27/01 FBO Ki Yong Choi Trust (a/k/a the Choi Family Living Trust, the “Trust”) (Mr. Choi and the Trust, collectively, the “Stockholders”) hereby nominate six persons (the “Nominees”) for election to the Company’s Board of Directors at the annual meeting of the Company’s stockholders currently scheduled for June 26, 2012 (including any adjournment or postponement thereof or any special meeting that may be called in lieu thereof, the “Annual Meeting”). The Nominees are: Ki Yong Choi, Michael D. Coffee, Gary Weinhouse, Warren Hoeffler, Michael W. Cho and Ajay Badlani. In this regard, please note the following:

| 1. | The Stockholders’ address is 36 Great Circle Drive, Mill Valley, California 94941. |

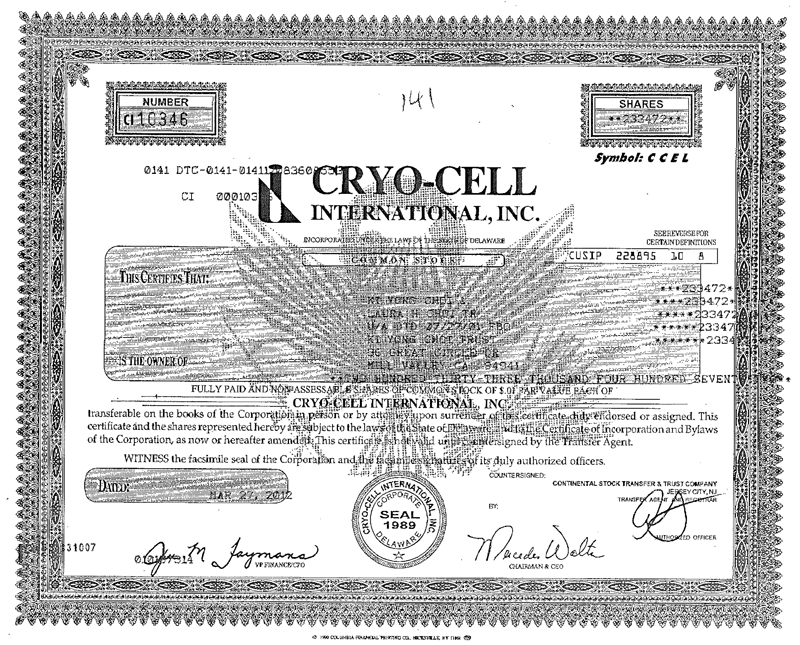

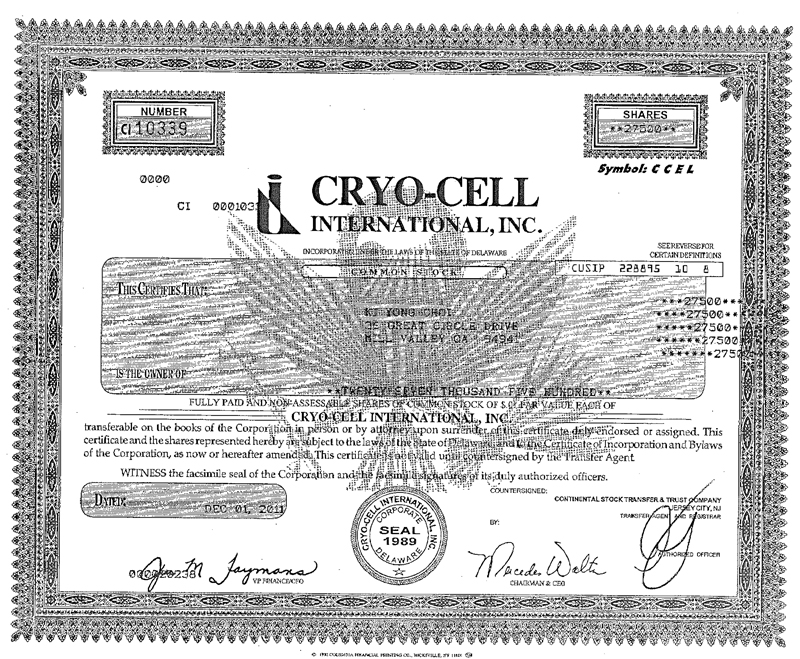

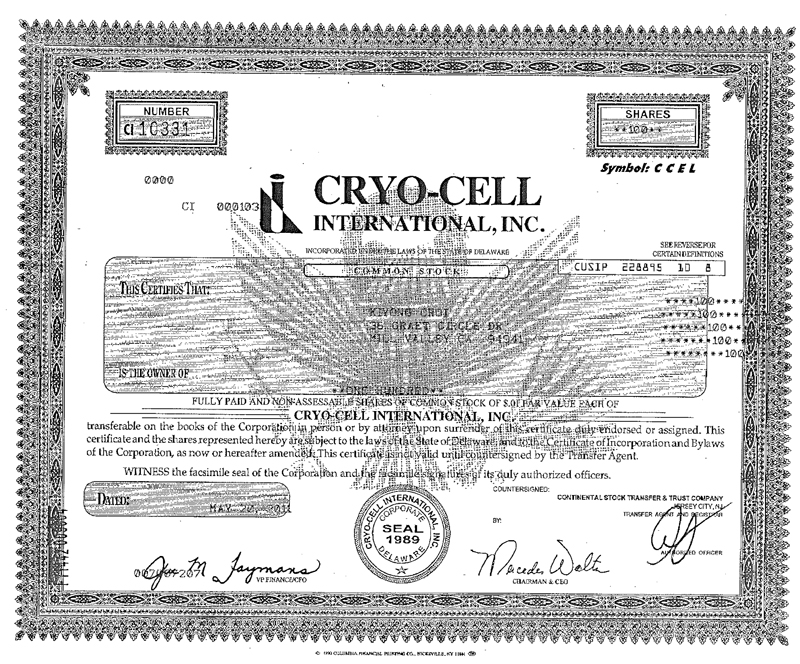

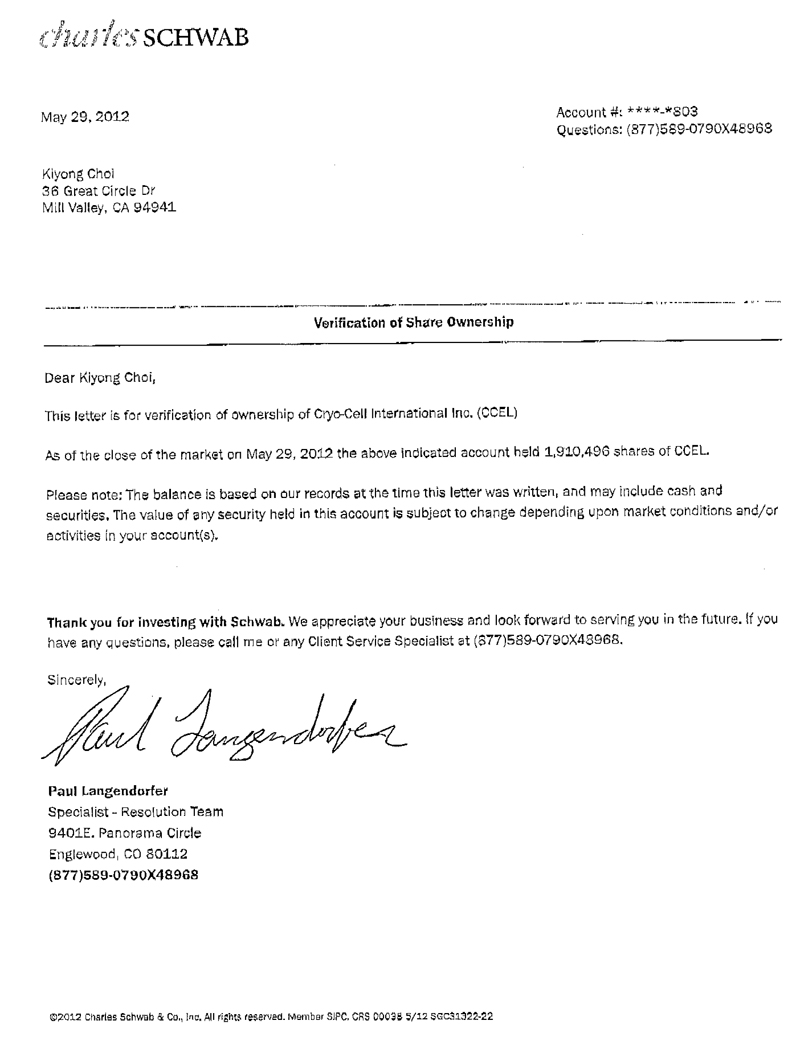

| 2. | The Stockholders represent that they are the holder of record or beneficial owner (as to Mr. Choi) and the holder of record (as to the Trust) of a total of 2,171,568 shares of common stock of the Company entitled to vote at the Annual Meeting. Attached as Annex 1 to this Notice is a copy of certificate number CI-10346 representing 233,472 shares of common stock issued in the name of the Trust and certificates numbered CI-10339, representing 27,500 shares of common stock, and CI-10331, representing 100 shares of common stock, issued in the name of Ki Yong Choi. Cede & Co., as the nominee of The Depositary Trust Company, is the holder of record of 1,910,496 shares of common stock held in Mr. Choi’s brokerage account. Attached as Annex 2 to this Notice is a letter from Charles Schwab verifying Mr. Choi’s beneficial holdings. |

| 3. | Mr. Choi and his spouse, Laura Choi, as trustees of the Trust, have voting and investment power over the common stock owned by the Trust. |

| 4. | There currently are no arrangements or understandings between the Stockholders, on the one hand, and any of the Nominees or any other person, on the other hand, pursuant to which the nominations of the Nominees are to be made. The Stockholders are acting in concert with each other for the purpose of nominating the Nominees. |

| 5. | Attached as Annex 3 to this Notice are the Nominees’ biographies including all information regarding each Nominee that would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission had the Nominees been nominated, or intended to be nominated, by the Board. |

| 6. | Attached as Annex 4 to this Notice is a signed consent of each of the Nominees to serve as a director of the Company, if so elected. |

| 7. | The Stockholders intend to deliver a proxy statement and form of proxy to holders of at least the percentage of shares of the Company entitled to vote required to elect the Nominees. |

| 8. | Mr. Choi, both individually and as the proxy for the Trust, represents that he intends to appear in person or by proxy at the Annual Meeting to nominate the Nominees. |

The Stockholders request that the Nominees’ names be included in the director nominations for the Annual Meeting.

The information provided is based on the knowledge of the Stockholders as of the date of this letter. The Stockholders reserve the right, in the event such information shall be or become inaccurate, to provide corrective information to the Company.

If this Notice is deemed for any reason to be ineffective with respect to the nomination of the Nominees, or if any of the Nominees becomes unable to serve for any reason, this Notice shall continue to be effective with respect to a replacement nominee for such Nominee whom the Stockholders may select. The Stockholders reserve the right to nominate, substitute or add additional persons or take other appropriate action if any change occurs in the Company’s Board or Bylaws after the date of this letter and prior to the Annual Meeting, or if the date of the Annual Meeting is delayed by more than 30 calendar days. The Stockholders reserve the right to give further notice of additional nominations or business to be conducted at the Annual Meeting or any other meeting of the Company’s stockholders, although as of the date hereof the Stockholders do not have any intention of doing so.

The Stockholders request written notice from the Company of the following no later than June 8, 2012:

| · | Confirmation that the size of the Board is currently fixed at a total of 6 directorships, and that there are currently no vacancies on the Board; |

| · | Confirmation that the Bylaws filed as Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed March 10, 2008 are currently in force as of the date hereof and no action has been taken by the Company’s Board to amend such Bylaws; |

| · | Either confirmation that this Notice complies with the notice requirements of Sections 3 and 10 of Article II of the Company’s Bylaws respecting advance notice of business to be brought before an annual meeting and nominations of directors by record stockholders, or identification of any alleged defects in this Notice that lead the Company to conclude that such notification requirements have not been complied with. |

If you have further questions regarding this matter, please contact Kevin Friedmann, Esq. of Richardson & Patel LLP, 750 Third Avenue, 9th Floor, New York, New York 10017. His telephone number is (212) 561-5559 and his e-mail address is kfriedmann@richardsonpatel.com.

| Very truly yours, | ||

| /s/ Ki Yong Choi | ||

| Ki Yong Choi | ||

| Choi Family Living Trust | ||

| By: | /s/ Ki Yong Choi | |

| Ki Yong Choi, Trustee | ||

| By: | /s/ Laura H. Choi | |

| Laura Choi, Trustee |

ANNEX 1

COPIES OF STOCK CERTIFICATES

ANNEX 2

LETTER FROM CHARLES SCHWAB

ANNEX 3

NOMINEE BIOGRAPHIES

Ki Yong Choi

Ki Yong Choi, age 50, served as a director of the Company from March 2008 to August 2011. Mr. Choi is an entrepreneur and an investor with a keen interest in biomedical sciences. He has been an owner, manager and operator of diverse businesses, including hotels (1992 to present), a television production company (1994 to 1999) and a transportation/tour company (1994 to 1997). Mr. Choi currently serves as President of Cathedral Hill Associates, Inc., a company he founded in 1992, which owns and operates full service hotels in the metropolitan areas of Seattle, Los Angeles and Dallas. As a business owner and as an investor, Mr. Choi has a clear understanding of business planning and operations, extensive experience in business management, and a keen sense of business development. Mr. Choi is an innovative problem solver and has strong leadership skills necessary to provide guidance and direction to the Company. Mr. Choi brings to the Board a broad spectrum of business know-how and strategic planning experience. As the single biggest stockholder of the Company, his primary objective is to ensure that the Company realizes its maximal potential and brings the greatest possible value to all of its stockholders. The Stockholders believe that Mr. Choi satisfies the director independence requirements of The NASDAQ Stock Market. Mr. Choi has consented in writing to being named in the proxy statement as a nominee and to serving as a director if elected. A copy of Mr. Choi’s consent is attached to this Notice.

Mr. Choi is the beneficial owner of 1,910,496 shares of the Company’s common stock held in Mr. Choi’s brokerage account and he is the owner of record of 27,600 shares of the Company’s common stock. Mr. Choi and his spouse, Laura Choi, as Trustees of the Trust (as defined in the Notice), are the beneficial owners of, and have voting and investment power over, 233,472 shares of the Company’s common stock owned of record by the Trust. Mr. Choi has exercised options for an additional 15,000 shares of common stock but has not yet received the certificate for those exercises.

Mr. Choi’s address is 36 Great Circle Drive, Mill Valley, California 94941.

On November 25, 2011 Mr. Choi exercised options to purchase a total of 42,500 shares of the Company’s common stock.

Mr. Choi is not, nor within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies.

Except for the fees described below which were paid to Mr. Choi for his services as a director, none of Mr. Choi, any member of his immediate family nor any of his associates was a party to any transaction, or series of similar transactions, since December 1, 2009, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount exceeds the lesser of $120,000 or 1% of the average of the Company’s total assets at year end for the last 2 completed fiscal years.

None of Mr. Choi nor any of his associates has any arrangement or understanding with any person with respect to any future employment by the Company or any of its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party.

No person, including Mr. Choi, who is a party to an arrangement or understanding pursuant to which Mr. Choi is proposed to be elected has a substantial interest, direct or indirect, by security holdings or otherwise, in any matter to be acted on at the Annual Meeting, aside from the election to serve as a director and such persons’ interests as stockholders of the Company.

There are currently no material pending legal proceedings to which Mr. Choi or any of his associates is a party adverse to the Company or any of its affiliates, or in which either Mr. Choi or any of his associates has a material interest adverse to the Company or any of its affiliates.

Mr. Choi has not had, during the Company’s last fiscal year, any business relationship that is required to be disclosed pursuant to Item 404(b) of Regulation S-K of the Securities Act of 1933, as amended.

Mr. Choi does not have any family relationship, by blood, marriage or adoption, to any current director, executive officer or other affiliate of the Company. Mr. Choi is the brother-in-law of Dr. Michael W. Cho, a Nominee.

Mr. Choi has not, during the past 10 years, been involved in any legal proceedings or involved in any other event described in Item 401(f) of Regulation S-K.

During the Company’s last 2 fiscal years, no compensation or personal benefits (including, without limitation, those which would be required to be disclosed pursuant to Item 402 of Regulation S-K) were awarded to, earned by or paid to Mr. Choi or any of his associates for any services rendered in any capacity to the Company or its subsidiaries or affiliates, other than the compensation Mr. Choi received for his service as a director of the Company as set forth in the Company’s Annual Report on Form 10-K for the fiscal years 2010 and 2011 and as set forth below:

| Fiscal Year | Fees Earned or Paid in Cash ($) | Option Awards ($)(1) | Total ($) | |||

| 2010 | $22,000 | $7,758 | $29,758 | |||

| 2011 | $17,000 | $6,264 | $23,264 |

| (1) | Represents the dollar amount recognized for financial reporting purposes in fiscal 2010 and 2011, as applicable, under SFAS 123R with respect to stock options. The fair value was estimated using the Black-Scholes option-pricing model. |

Mr. Choi was originally nominated to the Company’s Board of Directors in January 2008 pursuant to an agreement between the Company and Mr. Choi and certain of his affiliates as described in the Company’s Current Report on Form 8-K filed on January 24, 2008. Other than this agreement, there is no arrangement and/or understanding between Mr. Choi and any other person pursuant to which Mr. Choi was or is to be selected as a director nominee for election as a director of the Company.

Mr. Choi does not currently hold any position or office with the Company or any parent, subsidiary and/or affiliate thereof.

Gary Weinhouse

Gary D. Weinhouse, Esq., age 44, is a strategic, results-oriented and hands on executive with domestic and international experience building value in high growth companies. Mr. Weinhouse’s background includes over a decade of experience with health care organizations and a deep understanding of the health care and medical field. Since June 2010 Mr. Weinhouse has served as President of Autism Spectrum Therapies (AST), a private, for profit company which offers a wide range of programs for individuals with autism. AST has over 600 employees, 9 offices and multi-state operations. In February 2001 Mr. Weinhouse co-founded and is currently the Managing Director of W Capital Partners, LLC, a boutique consulting company focusing on interim senior management, operations improvement, turnarounds and restructurings. During 2009 and 2010, Mr. Weinhouse served as Chief Executive Officer of Liens, LLC, a private health care services firm. From August 2004 through September 2008, Mr. Weinhouse served as Chief Executive Officer of California Cryobank, Inc., one of the largest reproductive tissue banks in the world, and Family Cord, an umbilical cord blood processing and storage company. He has also served as interim Chief Operating Officer/Chief Financial Officer/Executive Vice President, Legal Affairs for Al & Ed’s Autosound, as Chief Operating Officer/Chief Financial Officer and Secretary of eteamz.com, and as Director of Operations and in house Counsel for Myo Diagnostics, Inc. (MPR Health Systems).

Mr. Weinhouse graduated with high honors, Phi Beta Kappa and Magna Cum Laude, from the University of California, Los Angeles (College Honors Graduate) with a Bachelor of Arts degree in political science. He holds a Master of Business Administration (MBA) from the Anderson School of Business at UCLA, a Juris Doctorate (JD) degree from Loyola Law School, and a Financial Consulting (PFP) professional designation from UCLA. Mr. Weinhouse is a member of the California State Bar (1993), is licensed to practice in federal and California state courts, and was elected to Young Presidents’ Organization (YPO), Malibu Chapter. Mr. Weinhouse brings to the Board a broad spectrum of business know-how and significant experience in the processing and storage of cord blood.

The Stockholders believe that satisfies the director independence requirements of The NASDAQ Stock Market. Mr. Weinhouse has consented in writing to being named in the proxy statement as a nominee and to serving as a director if elected. A copy of Mr. Weinhouse’s consent is attached to this Notice.

Mr. Weinhouse’s address is c/o 6950 Bristol Parkway, #100, Culver City, California 90230.

Mr. Weinhouse is the beneficial owner of no shares of the Company’s common stock.

Mr. Weinhouse has not effected any purchases or sales of securities of the Company during the past two years.

Mr. Weinhouse is not, nor within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies.

None of Mr. Weinhouse, any member of his immediate family nor any of his associates was a party to any transaction, or series of similar transactions, since December 1, 2009, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount exceeds the lesser of $120,000 or 1% of the average of the Company’s total assets at year end for the last 2 completed fiscal years.

None of Mr. Weinhouse nor any of his associates has any arrangement or understanding with any person with respect to any future employment by the Company or any of its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party.

No person, including Mr. Weinhouse, who is a party to an arrangement or understanding pursuant to which Mr. Weinhouse is proposed to be elected has a substantial interest, direct or indirect, by security holdings or otherwise, in any matter to be acted on at the Annual Meeting, aside from the election to serve as a director of the Company.

There are currently no material pending legal proceedings to which Mr. Weinhouse or any of his associates is a party adverse to the Company or any of its affiliates, or in which either Mr. Weinhouse or any of his associates has a material interest adverse to the Company or any of its affiliates.

Mr. Weinhouse has not had any business relationship that is required to be disclosed pursuant to Item 404(b) of Regulation S-K of the Securities Act of 1933, as amended.

Mr. Weinhouse does not have any family relationship, by blood, marriage or adoption, to any current director, executive officer or other affiliate of the Company or to any Nominee.

Mr. Weinhouse has not, during the past 10 years, been involved in any legal proceedings or involved in any other event described in Item 401(f) of Regulation S-K.

During the Company’s last 2 fiscal years, no compensation or personal benefits (including, without limitation, those which would be required to be disclosed pursuant to Item 402 of Regulation S-K) were awarded to, earned by or paid to Mr. Weinhouse or any of his associates for any services rendered in any capacity to the Company or its subsidiaries or affiliates.

There is no arrangement and/or understanding between Mr. Weinhouse and any other person pursuant to which Mr. Weinhouse was or is to be selected as a director nominee for election as a director of the Company.

Mr. Weinhouse does not currently hold any position or office with the Company or any parent, subsidiary and/or affiliate thereof.

Michael W. Cho, Ph.D.

Michael W. Cho, Ph.D., age 46, joined Iowa State University’s department of biomedical sciences in September 2009 as an associate professor and associate director of their newly established Center for Advanced Host Defenses, Immunobiotics and Translational Comparative Medicine. In April 2012, he was promoted to professor and he continues to hold the Lloyd Chair in Biomedical Sciences in the College of Veterinary Medicine. Dr. Cho earned his Ph.D. at the University of Utah in Cellular, Viral and Molecular Biology with an emphasis on molecular virology of picornaviruses. He expanded his expertise in virology during postdoctoral training at the National Institutes of Health, where he began working on characterizing structure-function of the envelope glycoprotein of human immunodeficiency virus type I (HIV-1), the virus that causes AIDS. Prior to joining Iowa State University, from 2001 to 2009, Dr. Cho was an assistant professor, and then an associate professor, in the Case Western Reserve University School of Medicine, Department of Medicine. During that same period he was also adjunct assistant professor and then adjunct associate professor with the Case Western Reserve University School of Medicine, Department of Biochemistry and from 2004 through 2009 he was an adjunct assistant professor and then an adjunct associate professor in the Department of Molecular Biology and Microbiology. From 2004 to 2009 he was Director, Molecular Virology and Gene Expression Core for the Case Western Reserve University Center for AIDS Research and from 2006 to 2009 he was Co-Director, Microbial Pathogenesis Core for the Case Western Reserve University Center for AIDS Research. From 2009 to 2011 he was Associate Director and from 2011 through the present he is the Co-Director of the Center for Advanced Host Defenses, Immunobiotics and Translational Comparative Medicine for Iowa State University. As a result of his medical background and research experience, Dr. Cho brings to the Board a broad spectrum of scientific knowledge and research and development experience in the biomedical field. Dr. Cho also brings to the Board his experience in overseeing three research programs funded by NIH with a budget of nearly $14 million.

From March 2010 through August 2011, Dr. Cho was a director of Cryo-Cell International, Inc.

The Stockholders believe that Dr. Cho satisfies the director independence requirements of The NASDAQ Stock Market. Dr. Cho has consented in writing to being named in the proxy statement as a nominee and to serving as a director if elected. A copy of Dr. Cho’s consent is attached to this Notice.

Dr. Cho’s address is c/o Iowa State University, College of Veterinary Medicine, Department of Biomedical Sciences, 1600 South 16th Street, Ames, Iowa 50011.

Dr. Cho holds 14,166 shares of the Company’s common stock. Other than these shares, none of Dr. Cho or any affiliate or associate of Dr. Cho owns any securities of the Company (either of record or beneficially).

During the past two years, Dr. Cho exercised options for the purchase of 14,166 shares of the Company’s common stock.

Dr. Cho is not, nor within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies.

Except for the fees described below which were paid to Dr. Cho for his services as a director, none of Dr. Cho, any member of his immediate family nor any of his associates was a party to any transaction, or series of similar transactions, since December 1, 2009, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount exceeds the lesser of $120,000 or 1% of the average of the Company’s total assets at year end for the last 2 completed fiscal years.

None of Dr. Cho nor any of his associates has any arrangement or understanding with any person with respect to any future employment by the Company or any of its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party.

No person, including Dr. Cho, who is a party to an arrangement or understanding pursuant to which Dr. Cho is proposed to be elected has a substantial interest, direct or indirect, by security holdings or otherwise, in any matter to be acted on at the Annual Meeting, aside from the election to serve as a director of the Company.

There are currently no material pending legal proceedings to which Dr. Cho or any of his associates is a party adverse to the Company or any of its affiliates, or in which either Dr. Cho or any of his associates has a material interest adverse to the Company or any of its affiliates.

Dr. Cho has not had any business relationship that is required to be disclosed pursuant to Item 404(b) of Regulation S-K of the Securities Act of 1933, as amended.

Other than Mr. Choi, who is Dr. Cho’s brother-in-law, Dr. Cho does not have any family relationship, by blood, marriage or adoption, to any current director, executive officer or other affiliate of the Company or to any Nominee other than Mr. Choi.

Dr. Cho has not, during the past 10 years, been involved in any legal proceedings or involved in any other event described in Item 401(f) of Regulation S-K.

During the Company’s last 2 fiscal years, no compensation or personal benefits (including, without limitation, those which would be required to be disclosed pursuant to Item 402 of Regulation S-K) were awarded to, earned by or paid to Dr. Cho or any of his associates for any services rendered in any capacity to the Company or its subsidiaries or affiliates, other than the compensation Dr. Cho received for his service as a director of the Company as set forth in the Company’s Annual Report on Form 10-K for the fiscal years 2010 and 2011 and as set forth below:

| Fiscal Year | Fees Earned or Paid in Cash ($) | Option Awards ($)(1) | Total ($) | |||

| 2010 | $20,000 | $3,649 | $23,649 | |||

| 2011 | $19,000 | $8,111 | $27,111 | |||

(1) Represents the dollar amount recognized for financial reporting purposes in fiscal 2010 and 2011, as applicable, under SFAS 123R with respect to stock options. The fair value was estimated using the Black-Scholes option-pricing model.

There is no arrangement and/or understanding between Dr. Cho and any other person pursuant to which Dr. Cho was or is to be selected as a director nominee for election as a director of the Company.

Since his service as a director ended, Dr. Cho does not currently hold any position or office with the Company or any parent, subsidiary and/or affiliate thereof.

Warren Hoeffler, Ph.D.

Since he founded it in July 1998, Dr. Hoeffler, age 56, has served as President and Chief Executive Officer of Xgene Corporation in Sausalito, California. The company focuses on technology to assemble primary cell cultures into larger tissue and organ components, and the storage of cell assemblies using their unique cryotronic freezing method. The company sponsors a laboratory at Dominican University in San Rafael California, where Dr. Hoeffler also teaches as an adjunct faculty member. Dr. Hoeffler trained as a postdoctoral fellow in the laboratory of Dr. Arthur D. Levinson at Genentech, Inc., currently a division of Hoffmann-La Roche. Dr. Hoeffler holds a Ph.D. from Washington University and an A.B. from Columbia University. He holds U.S. and European patents on technology to assemble organs from primary cell cultures, and U.S. and Japanese patents on gene expression, with other patents pending. Dr. Hoeffler brings to the Board his extensive experience in business, medicine, and biotechnology.

The Stockholders believe that satisfies the director independence requirements of The NASDAQ Stock Market. Dr. Hoeffler has consented in writing to being named in the proxy statement as a nominee and to serving as a director if elected. A copy of Dr. Hoeffler’s consent is attached to this Notice.

Dr. Hoeffler’s address is c/o XGene Corporation, 480 Gate 5 Road, Sausalito, California 94965.

Dr. Hoeffler is the beneficial owner of no shares of the Company’s common stock.

Dr. Hoeffler has not effected any purchases or sales of securities of the Company during the past two years.

Dr. Hoeffler is not, nor within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies.

None of Dr. Hoeffler, any member of his immediate family nor any of his associates was a party to any transaction, or series of similar transactions, since December 1, 2009, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount exceeds the lesser of $120,000 or 1% of the average of the Company’s total assets at year end for the last 2 completed fiscal years.

None of Dr. Hoeffler nor any of his associates has any arrangement or understanding with any person with respect to any future employment by the Company or any of its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party.

No person, including Dr. Hoeffler, who is a party to an arrangement or understanding pursuant to which Dr. Hoeffler is proposed to be elected has a substantial interest, direct or indirect, by security holdings or otherwise, in any matter to be acted on at the Annual Meeting, aside from the election to serve as a director of the Company.

There are currently no material pending legal proceedings to which Dr. Hoeffler or any of his associates is a party adverse to the Company or any of its affiliates, or in which either Dr. Hoeffler or any of his associates has a material interest adverse to the Company or any of its affiliates.

Dr. Hoeffler has not had any business relationship that is required to be disclosed pursuant to Item 404(b) of Regulation S-K of the Securities Act of 1933, as amended.

Dr. Hoeffler does not have any family relationship, by blood, marriage or adoption, to any current director, executive officer or other affiliate of the Company or to any Nominee.

Dr. Hoeffler has not, during the past 10 years, been involved in any legal proceedings or involved in any other event described in Item 401(f) of Regulation S-K.

During the Company’s last 2 fiscal years, no compensation or personal benefits (including, without limitation, those which would be required to be disclosed pursuant to Item 402 of Regulation S-K) were awarded to, earned by or paid to Dr. Hoeffler or any of his associates for any services rendered in any capacity to the Company or its subsidiaries or affiliates.

There is no arrangement and/or understanding between Dr. Hoeffler and any other person pursuant to which Dr. Hoeffler was or is to be selected as a director nominee for election as a director of the Company.

Dr. Hoeffler does not currently hold any position or office with the Company or any parent, subsidiary and/or affiliate thereof.

Michael D. Coffee

Mr. Coffee, age 66, is presently the Chief Business Officer for Medicinova, Inc., a position he has held since June 2010. From May 2009 to February 2010, he was Senior Vice President, Sales and Marketing, for Adamas Pharmaceuticals, Inc. From February 2005 to May 2009, Mr. Coffee was Chief Business Officer of Avigen, Inc., which was acquired by MediciNova in December 2009. Prior to joining Avigen, Mr. Coffee co-founded The Alekta Group, LLC, a consulting firm, in 2004 to provide a comprehensive range of pharmaceutical development consulting services to emerging pharmaceutical companies. From 2001 to 2004 Mr. Coffee served as President and Chief Operating Officer of Amarin Pharmaceuticals, Inc., the U.S. drug development and marketing subsidiary of Amarin Corporation PLC. Mr. Coffee also served as President and Chief Operating Officer of Elan Pharmaceuticals, North America from 1998 to 2001 and held marketing and executive management positions, including President and Chief Operating Officer, of Athena Neurosciences, Inc. between 1991 and 1998. Mr. Coffee received a B.S. degree in biology from Siena College and a Tuck Executive Program degree from Amos Tuck School of Business. Mr. Coffee brings to the Board excellent skills relating to managing life sciences businesses and developing businesses in the life sciences field.

The Stockholders believe that Mr. Coffee satisfies the director independence requirements of The NASDAQ Stock Market. Mr. Coffee has consented in writing to being named in the proxy statement as a nominee and to serving as a director if elected. A copy of Mr. Coffee’s consent is attached to this Notice.

Mr. Coffee’s address is 100 Via Los Altos, Tiburon, California 94920.

Mr. Coffee is the beneficial owner of no shares of the Company’s common stock.

Mr. Coffee has not effected any purchases or sales of securities of the Company during the past two years.

Mr. Coffee is not, nor within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies.

None of Mr. Coffee, any member of his immediate family nor any of his associates was a party to any transaction, or series of similar transactions, since December 1, 2009, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount exceeds the lesser of $120,000 or 1% of the average of the Company’s total assets at year end for the last 2 completed fiscal years.

None of Mr. Coffee nor any of his associates has any arrangement or understanding with any person with respect to any future employment by the Company or any of its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party.

No person, including Mr. Coffee, who is a party to an arrangement or understanding pursuant to which Mr. Coffee is proposed to be elected has a substantial interest, direct or indirect, by security holdings or otherwise, in any matter to be acted on at the Annual Meeting, aside from the election to serve as a director of the Company.

There are currently no material pending legal proceedings to which Mr. Coffee or any of his associates is a party adverse to the Company or any of its affiliates, or in which either Mr. Coffee or any of his associates has a material interest adverse to the Company or any of its affiliates.

Mr. Coffee has not had any business relationship that is required to be disclosed pursuant to Item 404(b) of Regulation S-K of the Securities Act of 1933, as amended.

Mr. Coffee does not have any family relationship, by blood, marriage or adoption, to any current director, executive officer or other affiliate of the Company or to any Nominee.

Mr. Coffee has not, during the past 10 years, been involved in any legal proceedings or involved in any other event described in Item 401(f) of Regulation S-K.

During the Company’s last 2 fiscal years, no compensation or personal benefits (including, without limitation, those which would be required to be disclosed pursuant to Item 402 of Regulation S-K) were awarded to, earned by or paid to Mr. Coffee or any of his associates for any services rendered in any capacity to the Company or its subsidiaries or affiliates.

There is no arrangement and/or understanding between Mr. Coffee and any other person pursuant to which Mr. Coffee was or is to be selected as a director nominee for election as a director of the Company.

Mr. Coffee does not currently hold any position or office with the Company or any parent, subsidiary and/or affiliate thereof.

Ajay Badlani

Ajay Badlani, age 46, has more than 20 years of overall experience with 8 years in the wealth management industry. In February 2011, Mr. Badlani became the Chief Investment Officer for a large Family office in Southwest Ohio. From September 2003 to December 2010, Mr. Badlani spent more than 7 years at The Citigroup Private Bank in New York where he managed the U.S. investment analytical group, which provided asset allocation and portfolio construction solutions to ultra-high net worth clients. During his tenure with Citibank, Mr. Badlani worked in all aspects of risk mitigation of multi-asset class portfolios and maintained client relationships with many of the bank’s ultra-high net worth clients. In 2008 he was given the Citi Private Bank’s Global Achievement award. Prior to joining Citibank, Mr. Badlani was Vice-President of the Investment Advisory Group for Diversified Investment Advisors, a subsidiary of the global insurance company, AEGON. Mr. Badlani is a Chartered Financial Analyst (CFA) and a member of the Association for Investment Management and Research. Mr. Badlani earned an MBA from the Johnson School of Management at Cornell University, a Master’s of Science in Chemical Engineering from the University of California at San Diego, and a Bachelor of Engineering in Chemical Engineering from the University of Roorkee in Roorkee, India. Mr. Badlani brings to the Board extensive experience in finance and investment and will be instrumental in assisting the Company with capital raising and management. Mr. Badlani also has the qualifications to become a member of the Company’s Audit Committee and the attributes of an audit committee financial expert.

The Stockholders believe that Mr. Badlani satisfies the director independence requirements of The NASDAQ Stock Market. Mr. Badlani has consented in writing to being named in the proxy statement as a nominee and to serving as a director if elected. A copy of Mr. Badlani’s consent is attached to this Notice.

Mr. Badlani’s address is 9024 Symmes Hill Court, Loveland, Ohio 45140.

Mr. Badlani is the beneficial owner of no shares of the Company’s common stock.

Mr. Badlani has not effected any purchases or sales of securities of the Company during the past two years.

Mr. Badlani is not, nor within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies.

None of Mr. Badlani, any member of his immediate family nor any of his associates was a party to any transaction, or series of similar transactions, since December 1, 2009, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount exceeds the lesser of $120,000 or 1% of the average of the Company’s total assets at year end for the last 2 completed fiscal years.

None of Mr. Badlani nor any of his associates has any arrangement or understanding with any person with respect to any future employment by the Company or any of its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party.

No person, including Mr. Badlani, who is a party to an arrangement or understanding pursuant to which Mr. Badlani is proposed to be elected has a substantial interest, direct or indirect, by security holdings or otherwise, in any matter to be acted on at the Annual Meeting, aside from the election to serve as a director of the Company.

There are currently no material pending legal proceedings to which Mr. Badlani or any of his associates is a party adverse to the Company or any of its affiliates, or in which either Mr. Badlani or any of his associates has a material interest adverse to the Company or any of its affiliates.

Mr. Badlani has not had any business relationship that is required to be disclosed pursuant to Item 404(b) of Regulation S-K of the Securities Act of 1933, as amended.

Mr. Badlani does not have any family relationship, by blood, marriage or adoption, to any current director, executive officer or other affiliate of the Company or to any Nominee.

Mr. Badlani has not, during the past 10 years, been involved in any legal proceedings or involved in any other event described in Item 401(f) of Regulation S-K.

During the Company’s last 2 fiscal years, no compensation or personal benefits (including, without limitation, those which would be required to be disclosed pursuant to Item 402 of Regulation S-K) were awarded to, earned by or paid to Mr. Badlani or any of his associates for any services rendered in any capacity to the Company or its subsidiaries or affiliates.

There is no arrangement and/or understanding between Mr. Badlani and any other person pursuant to which Mr. Badlani was or is to be selected as a director nominee for election as a director of the Company.

Mr. Badlani does not currently hold any position or office with the Company or any parent, subsidiary and/or affiliate thereof.

ANNEX 4

CONSENTS TO SERVE

CONSENT TO SERVE AS A DIRECTOR

AND BE NAMED IN PROXY STATEMENT

I, Ki Yong Choi, do hereby consent to serve as a director of Cryo-Cell International, Inc., a Delaware corporation, if nominated and elected to serve, and to be named in any required proxy statement, information statement, proxy card and/or other proxy soliciting materials.

May 25, 2012

| /s/ Ki Yong Choi | |

| Ki Yong Choi |

CONSENT TO SERVE AS A DIRECTOR

AND BE NAMED IN PROXY STATEMENT

I, Michael D Coffee, do hereby consent to serve as a director of Cryo-Cell International, Inc., a Delaware corporation, if nominated and elected to serve, and to be named in any required proxy statement, information statement, proxy card and/or other proxy soliciting materials.

May 25, 2012

| /s/ Michael D. Coffee | |

| Michael D Coffee |

CONSENT TO SERVE AS A DIRECTOR

AND BE NAMED IN PROXY STATEMENT

I, Gary Weinhouse, do hereby consent to serve as a director of Cryo-Cell International, Inc., a Delaware corporation, if nominated and elected to serve, and to be named in any required proxy statement, information statement, proxy card and/or other proxy soliciting materials.

May 28, 2012

| /s/ Gary Weinhouse | |

| Gary Weinhouse |

CONSENT TO SERVE AS A DIRECTOR

AND BE NAMED IN PROXY STATEMENT

I, Warren Hoeffler, do hereby consent to serve as a director of Cryo-Cell International, Inc., a Delaware corporation, if nominated and elected to serve, and to be named in any required proxy statement, information statement, proxy card and/or other proxy soliciting materials.

May 27, 2012

| /s/ Warren Hoeffler | |

| Warren Hoeffler |

CONSENT TO SERVE AS A DIRECTOR

AND BE NAMED IN PROXY STATEMENT

I, Michael Cho, do hereby consent to serve as a director of Cryo-Cell International, Inc., a Delaware corporation, if nominated and elected to serve, and to be named in any required proxy statement, information statement, proxy card and/or other proxy soliciting materials.

May 29, 2012

| /s/ Michael W. Cho | |

| Michael W. Cho |

CONSENT TO SERVE AS A DIRECTOR

AND BE NAMED IN PROXY STATEMENT

I, Ajay Badlani, do hereby consent to serve as a director of Cryo-Cell International, Inc., a Delaware corporation, if nominated and elected to serve, and to be named in any required proxy statement, information statement, proxy card and/or other proxy soliciting materials.

May 25th, 2012

| /s/ Ajay Badlani | |

| Ajay Badlani |

May 31, 2012

VIA FEDERAL EXPRESS AND

VIA FACSIMILE TO (813) 855-4745

Corporate Secretary

Cryo-Cell International, Inc.

700 Brooker Creek Boulevard, Suite 1800

Oldsmar, Florida 34677

Dear Sir or Madam:

Richardson & Patel LLP is legal counsel to Mr. Ki Yong Choi and Ki Yong Choi & Laura H. Choi TR U/A DTD 7/27/01 FBO Ki Yong Choi Trust (a/k/a the Choi Family Living Trust, the “Trust”) (Mr. Choi and the Trust, collectively, the “Stockholders”).

By this letter, the Stockholders are amending the information provided to you in the Notice that was transmitted to you by facsimile on May 30, 2012 and which you received by courier on May 31, 2012.

In this regard, please note the following changes to the information relating to Michael Cho, Ph.D., which is included in Annex 3 of the Notice.

Paragraph 5 of the information relating to Michael Cho, Ph.D. which states:

Dr. Cho holds 14,166 shares of the Company’s common stock. Other than these shares, none of Dr. Cho or any affiliate or associate of Dr. Cho owns any securities of the Company (either of record or beneficially).

is amended to state:

Dr. Cho is the record holder of 14,166 shares of the Company’s common stock. Other than these shares, none of Dr. Cho or any affiliate or associate of Dr. Cho owns any securities of the Company (either of record or beneficially).

Paragraph 6 of the information relating to Michael Cho, Ph.D. which states:

During the past two years, Dr. Cho exercised options for the purchase of 14,166 shares of the Company’s common stock.

is amended to state:

On November 25, 2011, Dr. Cho exercised options for the purchase of 14,166 shares of the Company’s common stock.

Corporate Secretary

Cryo-Cell International, Inc.

May 31, 2012

Page 2

The Stockholders also include the following information in Annex 3 for the Nominee named:

Ki Yong Choi: The address of Cathedral Hill Associates is 14299 Firestone Boulevard, La Mirada, California 90638.

Gary D. Weinhouse: The address of Autism Spectrum Therapies is 6059 Bristol Parkway, Suite 100, Culver City, California 90230.

Michael D. Coffee: The address of Medicinova, Inc. is 4350 La Jolla Village Dr., Suite 950, San Diego, California 92122. Medicinova, Inc. is a biopharmaceutical company that develops small molecule therapeutics for the treatment of diseases.

Ajay Badlani: The address of the Family Office is 6450 Sand Lake Road, Dayton, Ohio 45414. The Family Office is a single family wealth management firm.

Finally, this letter also adds the following to the Notice, “No Nominee, any member of his immediate family nor any of his associates was a party to any transaction, or series of similar transactions since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount exceeds $120,000.

If the Notice is deemed for any reason to be ineffective with respect to the nomination of the Nominees, or if any of the Nominees becomes unable to serve for any reason, this Notice shall continue to be effective with respect to a replacement nominee for such Nominee whom the Stockholders may select. The Stockholders reserve the right to nominate, substitute or add additional persons or take other appropriate action if any change occurs in the Company’s Board or Bylaws after the date of this letter and prior to the Annual Meeting, or if the date of the Annual Meeting is delayed by more than 30 calendar days. The Stockholders reserve the right to give further notice of additional nominations or business to be conducted at the Annual Meeting or any other meeting of the Company’s stockholders, although as of the date hereof the Stockholders do not have any intention of doing so.

| Very truly yours, RICHARDSON & PATEL LLP | ||

| By: | /s/ Kevin Friedmann | |

| Kevin Friedmann, Partner | ||