UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant: x Filed by a Party other than the Registrant: ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

CRYO-CELL INTERNATIONAL, INC.

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, schedule or registration statement no.: |

| (3) | Filing party: |

| (4) | Date filed: |

CRYO-CELL’s OPEN LETTER TO SHAREHOLDERS OUTLINES THE REAL STORY

Company’s Long-Term Strategy to Invest in the Business Beginning to Show Benefits

Oldsmar, Fla. – June 19, 2007 – Cryo-Cell International Inc. (OTC Bulletin Board: CCEL), recently sent a letter to Cryo-Cell shareholders in conjunction with its Annual Shareholder Meeting to be held in Oldsmar, Florida on July 16th. The Company urged its shareholders to consider the Board’s accomplishments and objectives described below. The Company stressed the importance of this vote and asked shareholders to vote their shares on the WHITE proxy card that they will receive by mail. The body of the letter sent to shareholders follows:

The July 16th annual meeting is less than a month away. Whether or not you plan to attend the Annual Meeting, your Board of Directors urges you to vote FOR your Board’s nominees today. Your vote is more critical this year than ever before, because the group led by David Portnoy has launched a campaign to take control of your Company without paying you a premium. This campaign is based on distorted one-sided information and personal attacks. We urge you to consider the whole story.

The Real Story about Cryo-Cell: Our Strategy of Investing In Our Business Is Just Starting to Show Its Benefits.

| • | In spite of intense industry competition, Cryo-Cell’s revenue increased by 129% from FY03 to FY06 from $7.5 million to $17.2 million. Following nine consecutive quarters of profitability from Q104 through Q106, in early 2006, your Board made the decision to invest in marketing activities and product diversification. |

| • | Product diversification in the newly emerging stem cell industry requires comprehensive market understanding; technological and regulatory expertise; investment and time. |

| • | Cryo-Cell’s May 2007 announcement of the Maternal Placental Stem Cell (MPSC) discovery and related intellectual property (IP) was possible, in part, because of the Board’s decision to invest in the growth of our business. As part of the Company’s long-term strategy, Cryo-Cell’s MPSC technology is expected to create a significant source of potential new revenue for Cryo-Cell. |

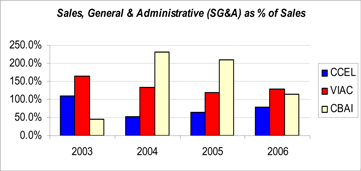

| • | In addition, our marketing initiatives, including our award-winning product rebranding, have positioned our core business for future growth. As shown in the table below, two public company competitors, ViaCell and Cord Blood America, spend a significantly greater percentage of their revenues than Cryo-Cell on Marketing & Sales. |

Figure 1: Based on SEC (Securities & Exchange Commission) Public Company Filings

| • | The past two years have been very challenging for our entire industry. For example, in April 2005, regulation of private cord blood banks by the Food and Drug Administration (FDA) impacted the entire industry with significantly increasing expense for all private cord blood banks to comply with new regulatory and accreditation standards. During this period, the stock prices of ViaCell and Cord Blood America have shown similar levels of volatility to that of Cryo-Cell. |

When presented from a balanced industry perspective, these facts depict a very different picture of Cryo-Cell’s progress than the negative portrayal described by Mr. Portnoy. The current team has remained steadfastly focused on building enterprise value based on our belief that value creation ultimately will drive the price of your stock over time. At this critical time, just as the benefits to Cryo-Cell are starting to be realized, Mr. Portnoy is asking shareholders to replace the current experienced team with a group of directors with a notable lack of relevant indicated professional experience and public company experience. This is the wrong move for Cryo-Cell and for the future of your investment.

This year the Board has nominated a sixth director, Andrew Filipowski. Mr. Filipowski is an entrepreneur who has founded several businesses over the past 20 years and has been an officer and director of several publicly held companies. In addition, he owns more than 6% of Cryo-Cell’s outstanding stock and he will bring to the Cryo-Cell boardroom the perspective of a large shareholder. Mr. Filipowski recently expressed his opinion to the media as follows:

“I always had confidence in Cryo-Cell and thought it was one of the best positioned in an industry that should create a lot of value and maybe even tremendous value; that is why I have bought as much of the company’s stock as I have. I actually was frustrated by the fact that the Company was making progress but certain shareholders were naively and with very little substantive experience in business looking to apply sophomoric gimmicks to spike the stock when the value of this company doing the right thing over time would generate 100 fold increases in value.” - Andrew J. Filipowski

Please cast your vote today to support the current Cryo-Cell Board of Directors and management team in our efforts to continue your Company’s progress. Shareholders are urged to cast their vote for the Cryo-Cell nominees by signing, dating and returning the white proxy card. Shareholders are also encouraged to discard the gold proxy card of the dissident group. Any shareholders requiring assistance may contact Georgeson Inc. that is providing Cryo-Cell with proxy solicitation services at (888) 605-7511.

About Cryo-Cell International, Inc.

Based in Oldsmar, Florida, with over 135,000 clients worldwide, Cryo-Cell is one of the largest and most established family cord blood banks. ISO 9001:2000 certified and accredited by the AABB, Cryo-Cell operates in a state-of-the-art Good Manufacturing Practice and Good Tissue Practice (cGMP/cGTP)-compliant facility. Cryo-Cell is a publicly traded company. OTC Bulletin Board Symbol: CCEL. Expectant parents or healthcare professionals may call 1-800-STOR-CELL (1-800-786-7235) or visit www.cryo-cell.com.

Forward-Looking Statement

Statements wherein the terms “believes”, “intends”, “projects” or “expects” as used are intended to reflect “forward-looking statements” of the Company. The information contained herein is subject to various risks, uncertainties and other factors that could cause actual results to differ materially from the results anticipated in such forward-looking statements or paragraphs, many of which are outside the control of the Company. These uncertainties and other factors include the uncertainty of market acceptance of any potential service offerings relating to types of stem cells other than cord blood stem cells, given that such new stem cells have not yet been used in human therapies, and treatment applications using such stem cells are subject to further research; the need to complete certain developments, including completion of clinical validation and testing, before any such process can be commercialized, and the Company’s development of its final business and economic model in offering any such service; any adverse effect or limitations caused by recent increases in government regulation of stem cell storage facilities; any increased competition in our business; any decrease or slowdown in the number of people seeking to store umbilical cord blood stem cells or decrease in the number of people paying annual storage fees; any adverse impacts on our revenue or operating margins due to the costs associated with increased growth in our business, including the possibility of unanticipated costs relating to the operation of our new facility; any technological breakthrough or medical breakthrough that would render the Company’s business of stem cell preservation obsolete; any material failure or malfunction in our storage facilities; any natural disaster such as a tornado, other disaster (fire) or act of terrorism that adversely affects stored specimens; the costs associated with defending or prosecuting litigation matters and any material adverse result from such matters; decreases in asset valuations; any continued negative effect from adverse publicity in the past year regarding the Company’s business operations; any negative consequences resulting from deriving, shipping and storing specimens at a second location; and other risks and uncertainties. The foregoing list is not exhaustive, and the Company disclaims any obligations to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements. Readers should carefully review the risk factors described in other documents the Company files from time to time with the Securities and Exchange Commission, including the most recent Annual Report on Form 10-KSB, Quarterly Reports on Form 10-QSB and any Current Reports on Form 8-K filed by the Company.