Mercedes

Walton Chairman & Chief Executive Officer Jill Taymans Chief Financial Officer Scott Christian Independent Outside Director OTC.BB: CCEL |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant: x Filed by a Party other than the Registrant: ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

CRYO-CELL INTERNATIONAL, INC.

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, schedule or registration statement no.: |

| (3) | Filing party: |

| (4) | Date filed: |

Mercedes

Walton Chairman & Chief Executive Officer Jill Taymans Chief Financial Officer Scott Christian Independent Outside Director OTC.BB: CCEL |

Statements wherein the terms “believes”, “intends”,

“projects” or “expects” as used are intended to reflect “forward-looking statements” of the Company. The information contained herein is subject to various risks, uncertainties and other factors that could cause actual results to differ materially from the results anticipated in such forward- looking statements or paragraphs. Readers/Audience should carefully review the risk factors described in other documents the Company files from time to time with the Securities and Exchange Commission, including the most recent Annual Report on Form 10-KSB, Quarterly Reports on Form 10-QSB and any Current Reports on Form 8-K filed by the Company. FORWARD-LOOKING STATEMENTS |

7

members Medical and Scientific Advisory Board 5 members (will become 6 at 2007 annual meeting) – all are elected annually – and all but sitting CEO are independent Board of Directors CCEL Public since 1991 OTC.BB $26 million Market Capitalization Oldsmar, FL Headquarters 1989 in Delaware Incorporation Mercedes Walton, Chairman & CEO W. Rob Doll, VP Marketing, Sales & Svc. Jill Taymans, Chief Financial Officer Julie Allickson, PhD, VP Lab Operations Officers 11.7 million Approx. 5,000 shareholders Shares Outstanding PUBLIC COMPANY PROFILE |

BUSINESS

OVERVIEW Greater than 135,000 worldwide Client Base Current: U-Cord ® Service. Collection and cryo- preservation of stem cells from umbilical cord blood Coming Soon: Maternal Placental Stem Cell (MPSC). Collection and preservation of proprietary, placental stem cells Services $1,595 for cord blood collection and preservation $125 for annual storage Current Service Fees Service fees for cord blood collection and preservation Recurring annual storage fees Licensing fees and royalties from global affiliates Revenue Sources United States Mexico, Central America, South America India, Singapore, Malaysia Markets Served One of the world's largest and most established cord blood stem cell banks |

Product

diversification: When launched Maternal Placental Stem Cell (MPSC) will be industry exclu sive service. CCEL owns intellectual property (IP) for MPSC and has commenced pre- clinical studies of the technology. Launch date to be announced in FY 07. Potential therapeutic applications for major diseases increasing interest and value of stem cell banking. CCEL will have highly differentiated marketing message: “Protect Your Baby, Protect Yourself”. Superior Quality Accreditations: Current Good Manufacturing/Good Tissue Practice compliance (cGMP/cGTP); ISO 9000:2001 accreditation; AABB (formerly American Association Blood Banks) certification. Continual enhancements in operational efficiencies for sustainable margin performance. Leveraging highly scalable Internet marketing initiatives; call center support and clinical

services strategies to target and grow consumer and professional markets. Loyal customer base driving repeat business and client referrals. Expanding global presence through turnkey business model. GROWTH DRIVERS |

U.S. CORD BLOOD

BANKING MARKET DYNAMICS Increased government regulation Significant capital investment High costs of operation Increasing presence of public cord blood banks High Barriers to Entry Approx. 25 competitors (of which two are publicly traded – VIAC and CBAI) 3 companies hold 75 - 80% market share Highly-Fragmented Current annual penetration rate: less than 8.0% (2) Low Penetration Rate 4 million annual births Target market: 800,000 to 1,000,000 annually (1) Large and Growing Market (1) Based on target demographics (2) Based on target market. First Call research estimates |

WHAT ARE STEM

CELLS? Distinguished by two important characteristics: • Unspecialized cells that renew themselves for long periods through cell division • Under certain physiologic or experimental conditions, can be induced to become specialized cells - Example: heart muscle cells or insulin-producing cells of pancreas Scientists primarily work with two kinds of stem cells from animals and humans that have different functions and characteristics: • Embryonic stem cells • Adult stem cells |

CRYO-CELL’s HIGHLY DIFFERENTIATED STEM CELL PLATFORM U-Cord ® Service Source of hematopoietic stem cells that can divide and become: • Blood cells • Immune system cells • Platelets High rate of engraftment and tolerance of HLA mismatches Can be transplanted to self (autologous) or others (allogeneic) • 6,000 estimated industry-wide transplants Cryo-Cell currently collects, tests, processes and preserves U-Cord ® blood stem cells Maternal Placental Stem Cells (MPSCs) Undifferentiated, multi-potent; potentially pluripotent cells Matched to donor (mother) Able to differentiate into three lineages (neural, bone, fat) Highly clonogenic (high self-renewing capacity) Potential to advance Women’s Healthcare by providing prospective therapeutic applications for broad range of diseases afflicting women (i.e. heart disease; diabetes; stroke; neurological disorders; osteoporosis; etc.) |

U-CORD

® STEM CELL COLLECTION AND PRESERVATION Increased awareness and acceptance among OB/GYNs • Influence interest among expectant parents Non-controversial, no moral or ethical dilemma Cord blood is proven treatment therapy for more than 70 diseases As research progresses, the therapeutic potential increases stored stem cell value |

U-CORD

® CURRENT AND FUTURE POTENTIAL Current Applications of Cord Blood Therapy Blood Cancers Bone Marrow Failure Syndromes Blood Disorders Congenital Metabolic Disorders Immune Deficiencies Current R&D Cardiac (post-MI treatment) Nerve Cell Repair (Alzheimer’s, Parkinson’s) Spinal Cord Injury |

Maternal

Placental Stem Cells (MPSCs) Cryo-Cell has isolated a new type of adult stem cell

with potential for treating a broad range of diseases in the future. • MPSCs are taken from the discarded placental tissue immediately after childbirth. • Maternal in nature, it is genetically matched with the mother. Researchers believe that MPSCs may serve as an alternative to embryonic stem cells in the development of human cellular therapies and for use in regenerative medicine associated with the donor (mother). • MPSCs have successfully differentiated into several other cell types, including neural, bone and fat cells. MPSC service to be offered commercially, when available, as a bundle with the Company’s U-Cord® service. Launch date to be announced in coming months. Clinical validation and testing for commercialization of the process needs to be complete. Final business and economic model is currently being developed. |

INVESTMENT

HIGHLIGHTS Established client base drives significant recurring revenue Isolation of the maternal placental stem cell (MPSC) with new therapeutic potential for advancing women’s healthcare Growing royalties from global affiliates • CRYO-CELL de Mexico, Asia CRYO-CELL Private Limited (India) 38% equity stake in R&D partner, Saneron CCEL Therapeutics, Inc. • Worldwide marketing rights to any products developed Fully licensed and accredited by AABB; ISO 9001:2000 certified State-of-the-art, cGMP- / cGTP-compliant manufacturing facility Strong cash position; no long-term debt |

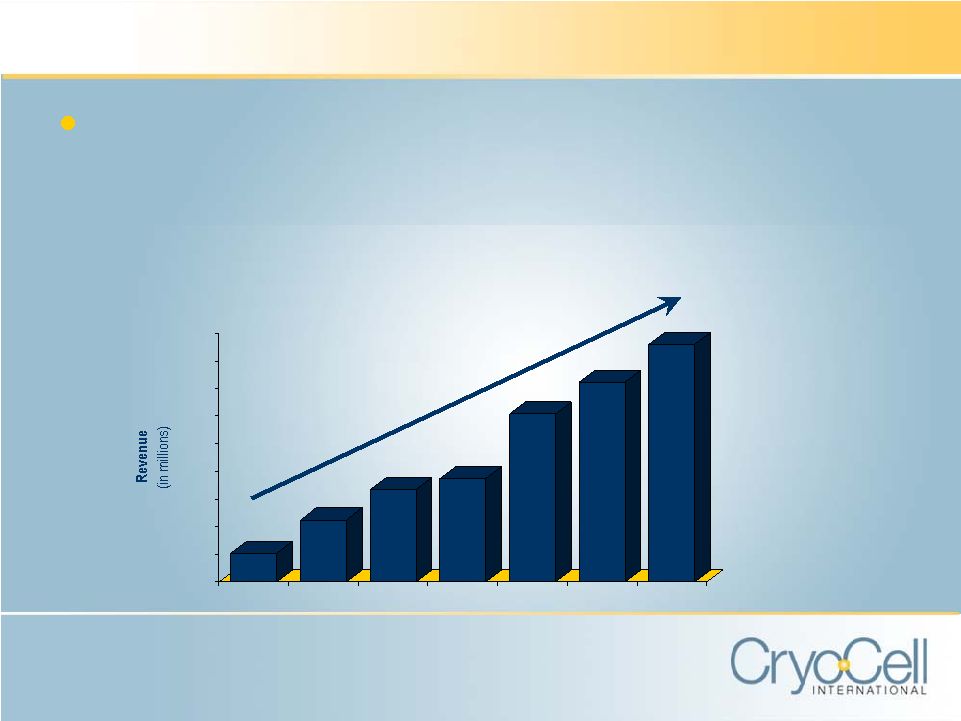

FINANCIAL

HIGHLIGHTS Proven Financial Performance • Growing installed base, increased service pricing • Strong cash position $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 2000 2001 2002 2003 2004 2005 2006 Fiscal Year Ended November 30, 2006 CAGR = 42% |

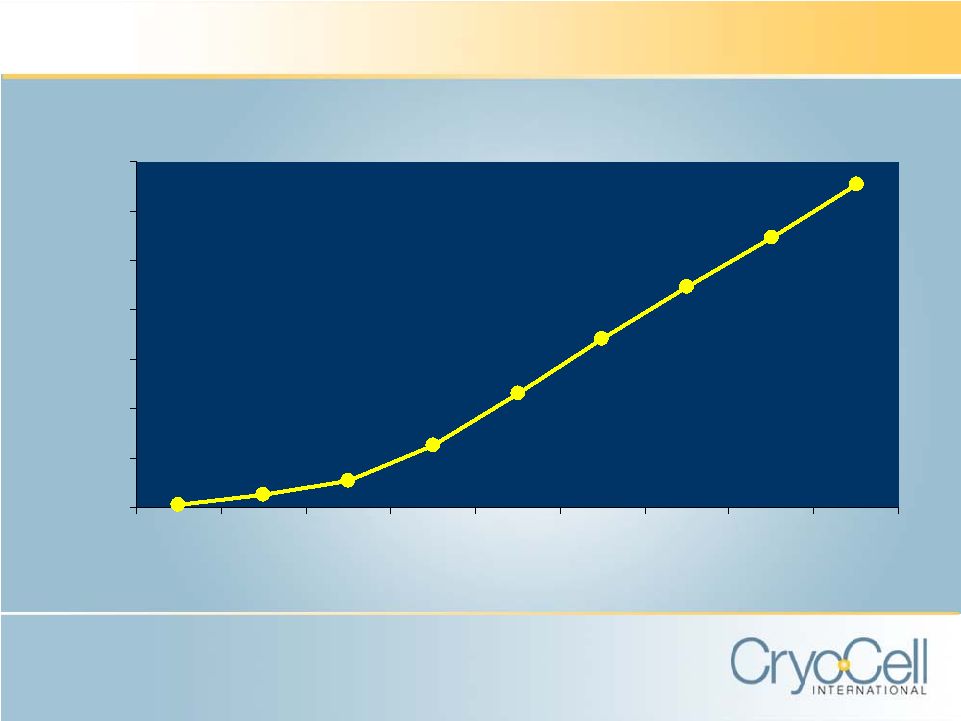

U-CORD® SPECIMENS PROCESSED AND STORED (CUMULATIVE) 0 20 40 60 80 100 120 140 1998 1999 2000 2001 2002 2003 2004 2005 2006 |

02/28/07 FY 2006 FY2005 FY2004 FY2003 Revenue $4.2M $17.2M $14.5M $12.2M $7.55M Gross Profit 63.7% 64.7% 71.3% 74.1% 65.2% Net (Loss) Income ($787K) ($2.8M) $1.0M $2.8M ($7.5M) (Loss) Earnings/ Share ($0.07) ($0.24) $0.09 $0.25 ($0.66) Cash & Equivalents $6.8M $8.5M $8.5M $6.0M $3.7M Long-Term Debt $0.0 $0.0 $0.0 $0.0 $0.0 FINANCIAL SUMMARY 3 Mos. Ended |

ANTICIPATED

MILESTONES Service Launch to be announced in coming months Maternal Placental Stem Cell (MPSC) & U-Cord® Bundle: Further diversification of service offering Unit growth established as top priority M&A opportunities as industry consolidates Geographical expansion Growth Strategy |

CORPORATE

GOVERNANCE Current board of 5 members -- each elected annually Will expand to six directors at this year’s annual meeting All but CEO are independent Audit, Compensation and Governance/Nominating Committees are comprised of entirely independent directors The Company does not have a poison pill Shareholders may call Special Meetings |

PROXY CONTEST

OVERVIEW A group led by David Portnoy, which holds approximately 13% of outstanding shares, has launched a proxy fight to replace the CCEL’s entire board. The Portnoy Group has no indicated, relevant experience in the stem cell preservation industry; regenerative science and women’s healthcare, nor do any Portnoy nominees have any relevant public company operating experience. The Portnoy Group consists of two brothers, an accountant with prior Portnoy affiliation, a professional with experience in water heaters and home comfort systems, a cardiologist, and a professional with experience in software and hardware integration solutions who also has business affiliations with Portnoy. CCEL Board does not believe that the Portnoy Group provides CCEL shareholders with any strategic direction or substantive operating plan.

|

PROXY CONTEST

OVERVIEW (continued) Cryo-Cell’s Nominees are successful executives /

professionals who bring proven leadership and business acumen to

Cryo-Cell. The Cryo-Cell nominees are professionally diverse and

include: Scott Christian – 27+ years of financial management experience Andrew Filipowski – A 6% holder of Cryo-Cell who is an entrepreneur Anthony Finch – 25 years of cell separation and cryopreservation experience Gaby Goubran – experience providing multi-national companies with business development services Jagdish Sheth, Ph.D. – experienced professor of marketing Mercedes Walton – CEO of Cryo-Cell. Has over 30 years of corporate management experience. Has approximately seven years of experience in stem cell preservation industry. |

PROXY CONTEST

OVERVIEW (continued) The Portnoy Group is seeking control of Cryo-Cell without paying a premium. The Portnoy Group does not provide any specific details on their plans for Cryo-Cell if they were

to be elected. Portnoy campaign based on distorted one-side information: - Omission of key facts: • Unprecedented financial turnaround from FY03 - FY06 • 129% revenue growth from FY03 – FY06 • Industry impacts of April 2005 FDA oversight and new regulatory standards • Deliberate decision by CCEL Board to invest in business growth • Technological breakthrough of MPSC: potential new revenue impact • CCEL’s relative SGA performance vs. public company competitors • CCEL’s relative operating income performance vs. public company competitors • CCEL’s relative stock volatility vs. public company competitors • Only public private cord blood company to reach profitability • CEO performed in interim capacity for 14 months from FY03-FY04 without cash compensation. |

CRYO-CELL vs. PUBLIC COMPETITORS 0.0% 100.0% 200.0% 300.0% 2003 2004 2005 2006 SGA as % of Sales CCEL VIAC CBAI |

The Real

Story about Cryo-Cell: Strategy of Investing in Our Business Is Just

Starting to Show Its Benefits CCEL’s revenue increased by 129% from FY03 to FY06 from $7.5M to $17.2 M. Nine consecutive quarters of profitability from Q104 through Q106. Early 2006: Board decision to invest in growth. Product Diversification in newly emerging stem cell industry requires: Comprehensive Market Understanding Expansive technological and regulatory expertise Investment Time May 2007 announcement of CCEL’s MPSC discovery and related IP possible, in part, because of Board’s decision to invest in growth of the business CCEL’s long-term strategy: MPSC technology expected to create significant source of potential new revenue CCEL’s product and corporate rebranding have successfully positioned core business for future growth Two public company competitors, Viacell (VIAC) and Cord Blood America (CBAI) spend significantly greater percentage of revenues than CCEL on SG&A. |

|