UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement | |||

| ¨ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ¨ |

Definitive Proxy Statement | |||

| x |

Definitive Additional Materials | |||

| ¨ |

Soliciting Material Pursuant to § 240.14a-12 | |||

|

Cryo-Cell International,

Inc. | ||||

| (Name of Registrant as Specified in its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x |

No fee required. | |||

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) Title of each class of securities to which transaction applies:

| ||||

|

| ||||

| (2) Aggregate number of securities to which transaction applies:

| ||||

|

| ||||

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| ||||

|

| ||||

| (4) Proposed maximum aggregate value of transaction:

| ||||

|

| ||||

| (5) Total fee paid:

| ||||

|

| ||||

| ¨ |

Fee paid previously with preliminary materials. | |||

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) Amount previously paid:

| ||||

|

| ||||

| (2) Form, Schedule or Registration Statement No.:

| ||||

|

| ||||

| (3) Filing Party:

| ||||

|

| ||||

| (4) Date Filed:

| ||||

|

| ||||

August 3, 2011

ELECT THE COMPANY’S NOMINEES TO YOUR BOARD OF DIRECTORS BY

VOTING THE WHITE PROXY CARD TODAY

VOTE THE WHITE CARD FOR STRONG MANAGEMENT AND

SUSTAINABLE LONG-TERM PERFORMANCE

Dear Stockholder:

Cryo-Cell’s 2011 Annual Meeting of Stockholders on August 25, 2011 is fast approaching. At the meeting, you will be given an important opportunity to cast your vote in support of your Board of Directors and its role in continuing to build on a solid foundation for what we believe will be significant and enduring success.

Your Board of Directors has nominated six highly seasoned professionals – Scott Christian, Andrew Filipowski, Anthony Finch, James P. Pellow Ed.D, Anthony Atala, M.D., and myself - all of whom share a deep commitment to serving your best interests as investors in the business of regenerative medicine.

This year’s meeting is of particular importance because a group of stockholders led by David Portnoy, a dissident stockholder, has proposed a slate of hand-picked nominees in opposition to the slate nominated by your Board of Directors.

CRYO-CELL’S BOARD SLATE IS EXPERIENCED, FOCUSED AND INDEPENDENT

Your Board’s slate is comprised of seasoned executives, who are well-respected, and bring proven leadership and business acumen to Cryo-Cell. This slate is comprised of the current Board members who led the turnaround at Cryo-Cell that resulted in ten quarters of profitability from Q109 through Q211 and two consecutive quarters of double-digit unit growth and revenue growth so far in FY11, which is further strengthened with the addition of James P. Pellow Ed.D and Anthony Atala, M.D. As successful executives of their own firms and as independent directors of Cryo-Cell, your Board has been instrumental in guiding Cryo-Cell to achieve product and service diversification by becoming a global leader in innovative stem cell solutions, particularly as related to prospective applications in the vast and emerging field of women’s healthcare.

We urge you to elect the Company’s nominees because they are diverse, focused on performance and above all, committed to representing the interests of all Cryo-Cell stockholders.

| • | Scott Christian has more than 30 years of financial management experience with companies such as Automatic Data Processing, Ceridian Corporation, Norstan, Spanlink Communications and XATA, in successively expanded roles from Senior Vice President of Finance through Chief Financial Officer to the CEO level. He brings to the Cryo-Cell boardroom his experience in global communications solutions and services and his deep knowledge of financial management. |

| • | Andrew J. Filipowski is an entrepreneur who has founded several businesses over the past 25 years. In addition to his entrepreneurial vision, Mr. Filipowski, who owns in excess of 5.5% of Cryo-Cell’s outstanding stock, brings to the Cryo-Cell boardroom the perspective of a large stockholder. |

| • | Anthony P. Finch has over 35 years of experience in cell separation and cryopreservation of cellular products. Currently, Mr. Finch serves as Chief Scientific Officer of the Irish National Blood Centre and |

| National Tissue Typing Reference Laboratory. Most importantly, he has over 20 years experience in cord blood processing and pioneered the fractionation and isolation of cord blood stem cells for small volume cryogenic storage and has developed large scale processing in line with current Good Manufacturing Practice (cGMP). He has established several cord blood stem cell banks in the United States, Europe and Asia. As an independent director to Cryo-Cell, Mr. Finch brings his wealth of experience and expertise in cord blood stem research, management, organization and processing. He is a Fellow of both the Academy of Medical Laboratory Sciences and Institute of Biomedical Sciences, and is a member of the Cord Blood Stem Cell International Society. |

| • | James P. Pellow Ed.D has over 25 years of professional experience and has served as a director of public companies in various roles, including lead director, chairman of the governance committee and member of the audit committee. As an independent director, Dr. Pellow will bring his significant corporate governance experience to the boardroom. Currently, Dr. Pellow serves as CEO and president of the Council on International Educational Exchange (CIEE). Dr. Pellow served as the executive vice president and chief operating officer of St. John’s University from 1999 until May 2011 and in various other capacities since 1991. Prior to joining St. John’s University in 1991, he was a certified public accountant with Coopers & Lybrand and a municipal bond trader with Chapdelaine & Co. |

| • | Anthony Atala, M.D., has over 25 years of professional experience and is a globally recognized stem cell researcher in the area of regenerative medicine. His current work focuses on growing new human cells, tissues and organs. Currently, Dr. Atala serves as Director of the Wake Forest Institute for Regenerative Medicine and has a team of over 160 physicians and researchers and is the W.H. Boyce Professor and Chair of the Department of Urology at Wake Forest University. Dr. Atala works with several journals and serves in various roles, including Editor-in-Chief of Stem Cells Translational Medicine and Current Stem Cell Research and Therapy. Dr. Atala has served as a director on several boards. Dr. Atala is currently an NIH “Quantum Grant” awardee and has published more than 250 journal articles and has applied for or received over 200 national and international patents. |

| • | Mercedes Walton has over 35 years of corporate management experience with significant senior executive expertise in the creation and implementation of innovative commercialization strategies for a variety of enterprises including AT&T; Applied Digital Solutions, Inc. and Digital Angel. Ms. Walton is the principal inventor on the expansive intellectual property portfolio of global patent-pending Célle menstrual stem cell technology applications assigned to the Company. Since 2000, Ms. Walton has served on the board of directors of five publicly traded companies in the biotechnology and communication services sectors. Her vast and varied experiences in the global business community, along with nearly 11 years in the stem cell preservation industry, make Ms. Walton highly qualified to both lead your company and act as Chairman of your Board of Directors. |

THE PORTNOY NOMINEES BRING NO RELEVANT EXPERIENCE, ARE NOT

QUALIFIED AND HAVE NO PUBLIC COMPANY OR STEM CELL INDUSTRY

EXPERIENCE

In sharp contrast to the Cryo-Cell Board nominated slate, the Portnoy Group’s nominees have no relevant indicated experience in the stem cell preservation industry, business of regenerative science or relevant public company operating experience. The Portnoy Group consists of a hand-picked group of individuals who appear to have long-time personal and business relationships with David Portnoy. The group consists of Mark and David Portnoy, who are brothers; Harold Berger, an accountant who as part of his practice provides accounting services to Mark Portnoy and certain entities controlled by Mark Portnoy; George Gaines, a consultant to entities seeking to structure and raise capital for private equity funds; and Jonathan H. Wheeler, M.D., an OB/GYN.

THE PORTNOY SLATE BRINGS NO INSIGHT, NO BUSINESS PLAN, NO

STRATEGY AND NO TRACK RECORD TO CRYO-CELL

Your Board believes that the Portnoy Group does not provide Cryo-Cell or its stockholders with any strategic direction for the Company. The Portnoy Group’s overly simplistic platform to “eliminate any and all unnecessary costs” and “increase revenues by redirecting sales and marketing efforts” does not provide Cryo-Cell with any strategic direction or meaningful operating plan to create substantive stockholder value. We believe that Mr. Portnoy’s rhetoric will ring hollow in the new and complex frontier of regenerative medicine and women’s healthcare that is governed by rigorous scientific, technological, regulatory and commercialization protocols.

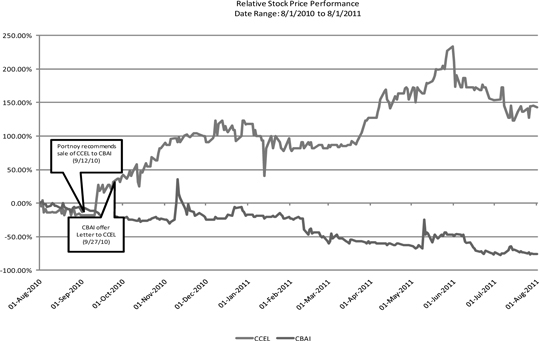

Conversely, as an empirical example of how misguided the Portnoy Group nominees are, on September 12, 2010, Mr. Portnoy, citing a personal relationship with the management of Cord Blood America (CBAI), wrote to the Cryo-Cell Board of Directors recommending that the Board sell its cord blood business to CBAI. Since that time, the CBAI stock price is down approximately 76%, while the Cryo-Cell stock price is up approximately 157%. The following graph depicts the relative stock price performance of CBAI and Cryo-Cell since Mr. Portnoy made that recommendation.

In an effort to avoid the high costs and disruption to the Company from yet another proxy contest, the Cryo-Cell Board offered Mr. Portnoy a seat on the Board soon after he submitted his nominations in May 2011. Mr. Portnoy rejected the Cryo-Cell board’s conciliatory offer, opting instead to wage a costly proxy contest. Clearly, Mr. Portnoy is not satisfied simply having a voice at the table, but rather is looking for board representation, and control, that far exceeds his current stock ownership. We have no reason to believe that Mr. Portnoy doesn’t have the same personal relationship with the management of CBAI and can only wonder at his true intentions. The Portnoy Group’s campaign ignores Cryo-Cell’s long-term outstanding performance, and his costly actions demonstrate a singular disregard for the serious potential damage they may cause on the broader base of Cryo-Cell stockholders, clients, business partners and employees.

|

To Protect Your Investment, We Urge You To Sign, Date And

Return The Enclosed WHITE Proxy Card Today.

|

THE FUTURE OF CRYO-CELL IS BRIGHT

Cryo-Cell is in the midst of the most exciting era in regenerative medicine and the stem cell industry. Management is working hard to execute a comprehensive strategy to lead stem cell innovation, spur growth through commercialization of stem cell services and build long-term value. In 2007, Cryo-Cell discovered and commercialized proprietary Célle® menstrual stem cell technology which became a potential game changer that shook the cord blood banking industry to its foundation. Through Célle technology the Company quickly established itself as a global player in the stem cell industry. Today, Cryo-Cell has:

| • | Over 235,000 clients worldwide |

| • | 24 global license affiliates |

| • | Célle, the world’s only menstrual stem cell service |

| • | Expansive intellectual property portfolio of proprietary menstrual stem cell technology |

| • | Strategic partnerships with globally renowned stem cell researchers |

| • | Unprecedented self-funded research and development business model |

| • | Expanded new services including Protect Baby, Protect Mom® U-Cord Plus®, P3®, and Cryology Reproductive Tissue Storage® |

Célle is licensed to eleven of the world’s leading stem cell researchers. Project funding is provided by Cryo-Cell’s research partners, with their commitment that therapeutic developments will be equally shared as the property of both Cryo-Cell and its partner. Cryo-Cell’s strategic innovation is supported by the Company’s patent-pending technology portfolio; market-leading global affiliate network; product development and strong relationships with the world’s leading stem cell researchers, all of which are key factors in the Company’s plan for long-term growth.

As disclosed in the latest earnings release, since the first quarter of fiscal 2009 Cryo-Cell has delivered ten consecutive quarters of operating profitability; and two consecutive quarters of double-digit unit growth and revenue growth. As of May 31, 2011, the Company had approximately $9.3 million in cash compared to $8.1 million at the close of second quarter 2010, representing a 15% increase. The Company had no long-term debt at the end of the second quarter 2011. Cryo-Cell’s share price at the close of second quarter 2011 was $3.67 compared to $1.25 at the end of the second quarter 2010, representing a 194% year-over-year increase.

SUPPORT YOUR BOARD’S HIGHLY QUALIFIED NOMINEES BY SIGNING AND

RETURNING THE WHITE PROXY CARD TODAY!

Your vote is very important to us, no matter the size of your holdings. To vote your shares, please sign, date and return the enclosed WHITE proxy card by mailing it in the enclosed pre-addressed, stamped envelope. Alternatively, you may be able to vote by internet or phone by following the instructions on the attached card. We urge you NOT to sign or return any blue proxy cards that may be sent to you by Mr. Portnoy, as that will nullify your vote on the WHITE proxy card. If you do return a blue proxy card or have already done so, you can automatically revoke it by signing, dating and returning your WHITE proxy card. If you have any questions or need any assistance voting your shares, do not hesitate to contact Georgeson Inc., who is assisting us in this matter, toll free at 1-888-642-8066.

We appreciate your continued support.

On behalf of your Board of Directors,

Mercedes Walton

Chairman and Chief Executive Officer

| If your shares are registered in your own name, please sign, date and mail the enclosed WHITE Proxy Card to Georgeson Inc. in the self-addressed, postage-paid envelope provided today.

If your shares are held in the name of a brokerage firm, bank nominee or other institution, please sign, date and mail the enclosed WHITE Voting Instruction Form in the self-addressed, postage-paid envelope provided. Remember--only your latest dated proxy will determine how your shares are to be voted at the meeting.

If you have any questions or need assistance in voting your shares, please contact our proxy solicitor:

199 Water Street, 26th Floor New York, NY 10038 Banks and Brokers (212) 440-9800 Stockholders Call Toll Free (888) 642-8066 |