UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ¨ | Definitive Proxy Statement | |||

| x | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to § 240.14a-12 | |||

|

Cryo-Cell International,

Inc. | ||||

| (Name of Registrant as Specified in its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) Title of each class of securities to which transaction applies:

| ||||

|

| ||||

| (2) Aggregate number of securities to which transaction applies:

| ||||

|

| ||||

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| ||||

|

| ||||

| (4) Proposed maximum aggregate value of transaction:

| ||||

|

| ||||

| (5) Total fee paid:

| ||||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) Amount previously paid:

| ||||

|

| ||||

| (2) Form, Schedule or Registration Statement No.:

| ||||

|

| ||||

| (3) Filing Party:

| ||||

|

| ||||

| (4) Date Filed:

| ||||

|

| ||||

Contact:

Julia Avery (Investors)

Stern Investor Relations, Inc.

212-362-1200

julia@sternir.com

Irene Smith (Media)

Cryo-Cell International, Inc.

813-749-2100

ismith@cryo-cell.com

CRYO-CELL LETTER TO SHAREHOLDERS

Company Highlights Strong Performance and Recommends Shareholders Vote in Favor of

Highly Qualified Slate of Six Director Nominees

Oldsmar, Fla. – August 16, 2011 – Cryo-Cell International, Inc. (OTCQX: CCEL) today issued the following letter, which will be mailed to its stockholders.

August 16, 2011

Dear Stockholders,

Cryo-Cell’s Annual Meeting of Stockholders is less than two weeks away and we are writing to ask for your support. Cryo-Cell has nominated six candidates for election to our Board, including four highly experienced incumbent directors and two accomplished new independent nominees. As you may be aware, David Portnoy, a shareholder with control of approximately 16% of Cryo-Cell’s outstanding stock, has nominated an alternative slate of five candidates with the intention of gaining control of Cryo-Cell. Your Board recommends that you reject the Portnoy Group’s designees that include him, family and business associates. We respectfully ask that you support all six of Cryo-Cell’s candidates, who are committed to acting in the best interests of all Cryo-Cell stockholders.

Cryo-Cell Continues to Perform Well with Strong Positioning for Long-Term Growth

Célle Proprietary Technology, Globalization and New Products Create a

Strategically Diversified Pipeline with a Strong Foundation for Future Growth

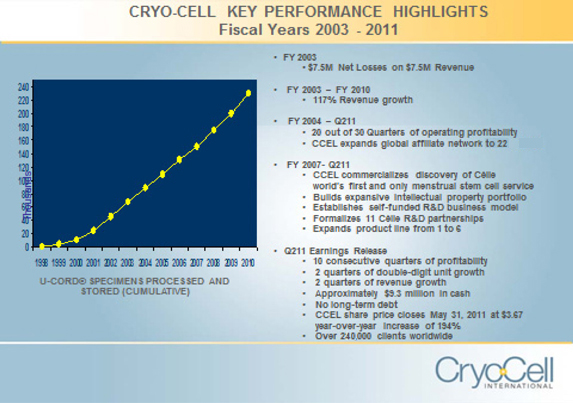

The cornerstone of value creation in our highly competitive stem cell industry is the ability to bring new products to market successfully while expanding strategic distribution channels. Since 2007, Cryo-Cell has expanded from a single product, the Company’s signature U-Cord™ service, to six products including Célle® Protect Baby, Protect Mom®; U-Cord Plus®; P3®; and Cryology Reproductive Tissue Storage®. We are very excited about these new products and expect them to drive growth and diversify revenue over the long term. At the same time, Cryo-Cell has expanded our network of global license affiliates to 22 markets around the world. Globalization is expected to strengthen Cryo-Cell’s distribution channels while bringing new sources of revenues from licensing, processing and storage of human tissue products.

Mr. Portnoy would like for stockholders to ignore Cryo-Cell’s strong track record of performance, including expansive product diversification; our vast portfolio of proprietary technology; the fast-growing global affiliate network; long-term profitability and two quarters of double-digit unit growth as well as revenue growth. Despite Mr. Portnoy’s one-side representation, Cryo-Cell has delivered enviable industry achievements despite the many challenges of the worst recession impacting discretionary consumer spending since the Great Depression.

Mr. Portnoy does not explain his criticism of Cryo-Cell’s growth strategy, and there is simply no merit to his suggestion that the Company has not successfully executed to achieve long-term profitability and growth in fiscal 2011. In addition, the current Cryo-Cell board facilitated development of proprietary Célle technology as a lynchpin to build future stockholder value. Not only does Mr. Portnoy fail to substantively identify meaningful areas on which he would focus the Company, he ignores the fact that Cryo-Cell has been successful both operationally and with the Company’s self-funded development of a potentially massive pipeline of promising new technology crossing a vast spectrum of therapeutic areas representing huge possible upside for Cryo-Cell stockholders.

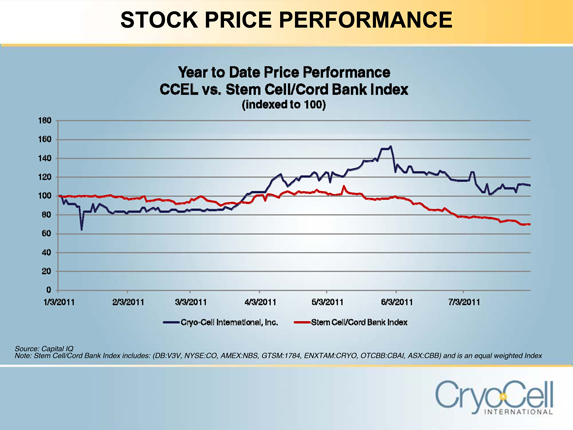

Cryo-Cell’s Nominees Will Drive Continued Growth of the Business

Cryo-Cell’s nominees have a combination of complementary skill sets and industry experience that set them apart from Mr. Portnoy’s nominees. The Cryo-Cell slate is composed of independent professionals with expansive expertise in public company operations; finance; strategy; the stem cell industry and regenerative medicine. Over the last several years, the Company’s incumbent directors have guided Cryo-Cell’s growth strategy while overseeing long-term profitability and recent double-digit unit and revenue growth. The Board is determined to ensure that Cryo-Cell is well positioned to build on this track record, execute its strategy and deliver value to shareholders in the future. We are confident that our nominees will provide the leadership and continuity necessary at this exciting and critical time for Cryo-Cell. Despite high market and industry volatility, Cryo-Cell’s share price has recently outperformed the stem cell/cord bank index as depicted on the chart below.

When It Comes to Mr. Portnoy’s Nominees, The Question Is Not

“What’s the Harm?” But “Are They The Best for Cryo-Cell?”

With the addition of Cryo-Cell’s two new nominees, we have carefully assembled a world-class board. Our director candidates have a diverse and specialized skill set that will help guide Cryo-Cell through the exciting commercialization of the Company’s proprietary technology; product diversification and global expansion. We believe that corporate boards should be assembled based upon the leadership qualities, experience and expertise of the directors - not based on the apparent self-interest of a single, vocal shareholder, who rejected the board’s offer for a seat at the table in lieu of his interest in obtaining full control over Cryo-Cell.

As you make your final determination regarding your very important vote in the election of directors, we strongly urge you to consider the reservations expressed by two proxy advisory firms, Institutional Shareholder Services (ISS) and Glass Lewis & Co., regarding the lack of qualification of the Portnoy Group’s slate of nominees, and vote your shares FOR the election of management’s nominees on the WHITE proxy card.

THE PORTNOY GROUP’S NOMINEES LACK RELEVANT EXPERIENCE;

NOMINEES ARE TOO CLOSELY RELATED TO MR. PORTNOY;

PLAN DOES NOT WARRANT SUPPORT

In its report regarding the election of directors at Cryo-Cell’s August 25, 2011 annual

meeting of stockholders, ISS stated the following about the Portnoy Group’s slate*:

…we have reservations about the lack of industry expertise, the lack of public company director experience, the lack of executive operating experience, and the potential – if all goes well – for future conflicts of interests….

Similarly, Glass Lewis stated *:

…we agree with the Company that most of the [Portnoy Group’s] nominees lack relevant experience that would qualify them for service on Cryo-Cell’s board. We also agree with the Company that the nominees are too closely related to Mr. Portnoy, which most likely explains their appearance on the [Portnoy Group’s] slate, as opposed to any industry-specific or public-board experience. Further, the [Portnoy Group’s] plan is far too general, in our view, for shareholders to throw their full weight behind in light of the Company’s current positive direction. A plan to simply cut unnecessary costs and employ new sales tactics to spur revenue growth is not robust enough to warrant support, in our view.

CURRENT BOARD DESERVES CREDIT FOR

COMPANY’S RECENT PERFORMANCE

In commenting on the company’ recent financial performance, ISS noted*:

…the company’s financial results over the past several years show promising improvement, even as it faces revenue headwinds from a public option which costs potential clients nothing. … [T]here is nothing in the company’s income statement to suggest the current market equation is unsustainable, or that the company is trending in the wrong direction.

Glass Lewis similarly commented*:

…we believe the current board and management team deserve credit for the Company’s relatively high profit margins, low discretionary expenses compared to peers and recent string of … profitable quarters.

We believe that the Portnoy Group has not presented Cryo-Cell stockholders with any good reasons to support its unqualified nominees. Your Board’s nominees are highly qualified directors who will continue to serve the interests of all stockholders.

| * | Permission to use quotations was neither sought nor obtained. |

SUPPORT YOUR BOARD’S HIGHLY QUALIFIED NOMINEES BY

SIGNING AND RETURNING THE WHITE PROXY CARD TODAY!

Your vote is very important to us, no matter the size of your holdings. To vote your shares, please sign, date and return the enclosed WHITE proxy card by mailing it in the enclosed pre-addressed, stamped envelope. Alternatively, you may be able to vote by internet or phone by following the instructions on the attached card. We urge you NOT to sign or return any blue proxy cards that may be sent to you by Mr. Portnoy, as that will nullify your vote on the WHITE proxy card. If you do return a blue proxy card or have already done so, you can automatically revoke it by signing, dating and returning your WHITE proxy card. If you have any questions or need any assistance voting your shares, do not hesitate to contact Georgeson Inc., who is assisting us in this matter, toll free at 1-888-642-8066.

We appreciate your continued support.

On behalf of your Board of

Directors,

Mercedes Walton

Chairman & Chief Executive Officer

If your shares are registered in your own name, please sign, date and mail the enclosed WHITE Proxy Card to Georgeson Inc. in the self-addressed, postage-paid envelope provided today.

If your shares are held in the name of a brokerage firm, bank nominee or other institution, please sign, date and mail the enclosed WHITE Voting Instruction Form in the self-addressed, postage-paid envelope provided. Remember--only your latest dated proxy will determine how your shares are to be voted at the meeting.

If you have any questions or need assistance in voting your shares, please contact our proxy solicitor:

199 Water Street, 26th Floor

New York, NY 10038

Banks and Brokers (212) 440-9800

Stockholders Call Toll Free (888) 642-8066

About Cryo-Cell International, Inc.

Based in Oldsmar, Florida, with over 240,000 clients worldwide, Cryo-Cell is one of the largest and most established family cord blood banks. ISO 9001:2008 certified and accredited by the AABB, Cryo-Cell operates in a state-of-the-art Good Manufacturing Practice and Good Tissue Practice (cGMP/cGTP)-compliant facility. In November 2007, the Company launched CelleSM (pronounced “C-L”), the world’s first-ever commercial service allowing women to cryopreserve their own menstrual stem cells. Cryo-Cell is a publicly traded company. OTC: QX Markets Group Symbol: CCEL. Expectant parents or healthcare professionals may call 1-800-STOR-CELL (1-800-786-7235) or visit www.cryo-cell.com.

About Celle

The CelleSM service was introduced in November 2007 as the first and only service that empowers women to collect and cryopreserve menstrual flow containing undifferentiated adult stem cells for future utilization by the donor or possibly their first-degree relatives in a manner similar to umbilical cord blood stem cells. For more information, visit www.celle.com.

Forward-Looking Statement

Statements wherein the terms “believes”, “intends”, “projects”, “anticipates”, “expects”, and similar expressions as used are intended to reflect “forward-looking statements” of the Company. The information contained herein is subject to various risks, uncertainties and other factors that could cause actual results to differ materially from the results anticipated in such forward-looking statements or paragraphs, many of which are outside the control of the Company. These uncertainties and other factors include the success of the Company’s global expansion initiatives and product diversification, the Company’s actual future ownership stake in future therapies emerging from its collaborative research partnerships, the success related to its IP portfolio, the Company’s future competitive position in stem cell innovation, future success of its core business and the competitive impact of public cord blood banking on the Company’s business, the Company’s ability to minimize future costs to the Company related to R&D initiatives and collaborations and the success of such initiatives and collaborations, the success and enforceability of the Company’s Celle technology license agreements and U-Cord license agreements and their ability to provide the Company with royalty fees, the ability of Cryology RTS to generate new revenues for the Company, and those risks and uncertainties contained in risk factors described in documents the Company files from time to time with the Securities and Exchange Commission, including the most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and any Current Reports on Form 8-K filed by the Company. The Company disclaims any obligations to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements.